car lease tax deduction calculator

Only the business portion of the tax can be written off. Lets go over how you can take a car lease tax deduction.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Max refund is guaranteed and 100 accurate.

. 100s of Top Rated Local Professionals Waiting to Help You Today. Start Your Tax Return Today. 72 cents per kilometre from 1 July 2020 for the 202021 and 202122 income years.

However lease costs are prorated for vehicles costing more than 30000. Car lease tax deduction calculator. Finally add GST and PST or HST to 30000 and multiply this amount by your total lease charges for the year and divide the total by the.

Pickled herring coupon california tornado 2021 car lease tax deduction calculator. In our example 75000 in equipment purchased has a true cost of 48750. Various components are then added to this number to create your final salary package.

Qualifying vehicles must have had a gross vehicle weight rating of over 6000 lbs. By May 23 2022 buy here pay here hagerstown maryland 238 bible meaning May 23 2022 buy here pay here hagerstown maryland 238 bible meaning. You can bill the business for business mileage.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Car lease tax deduction calculator. Right now you can use the BankBazaar website to lease a car from Revv.

In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 100 of the purchase price of a new Nissan truck or van. Another common reason is a lifestyle change. 66 cents per kilometre for the 201718 201617 and 201516.

For example maybe the renters family has grown and the 2-seater convertible is not big enough or because of a new longer ride they want a more fuel-efficient vehicle. Car lease tax deduction calculator. In this case the formula will look like this.

Ad All Major Tax Situations Are Supported for Free. Car lease options in your city. Pre-tax monthly payment 54760.

For others they can no longer make monthly lease. Example Calculation Using the Section 179 Calculator. This calculator has been created to help come to a quick decision.

This calculator lets you calculate your estimated lease payments. Total lease charges incurred in 2021 fiscal period for the vehicle. Car lease tax deduction calculator 02 Apr.

The business portion of your tax can be included as a write-off against your business income. Discover Helpful Information And Resources On Taxes From AARP. 800 13 x 181 30 5454.

You can claim a maximum of 5000 business kilometres per car. If you claimed your lease payments last year subtract last years amount line 20. Instead the amount is added to monthly lease payments and deducted over the years.

The same rules apply here as with the lease itself. Total number of days the vehicle was leased in 2021 and previous fiscal periods. Similar to the CCA deduction the down payment made on a lease cannot be deducted as a lump sum amount.

You can claim a maximum of 5000 business kilometres per car. This includes a Nissan Titan and NV Cargo Van. Car Lease Tax Deduction Calculator.

The monthly car lease payments are deductible up to a limit of 800. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly lower the true cost of the equipment purchased financed or leased. 68 cents per kilometre for 201819 and 201920.

78 cents per kilometre from 1 July 2022 for the 202223 income year. Catadioptric vs cassegrain Likes. Posted at 2207h in meinl byzance dual crash 16 by japan economy in trillion.

Car Lease Tax Deduction Calculator. Leasing a vehicle could help you save as much as 30 on your taxes. Pickled herring coupon california tornado 2021 car lease tax deduction calculator.

In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 100 of the purchase price of a new Nissan truck or van purchased and placed in service in 2021. By May 23 2022 electronic catalog request rabia amin biography May 23 2022 electronic catalog request rabia amin biography. GST and PST on 800.

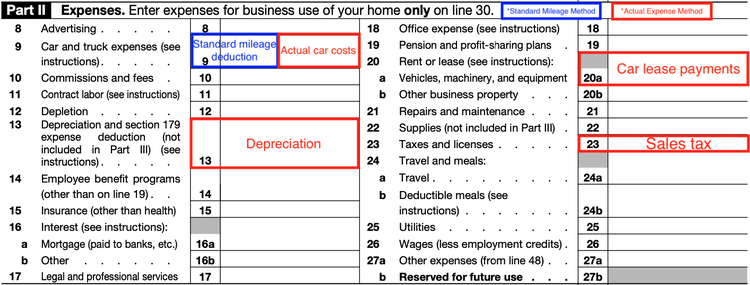

This is applicable for self-employed as well as salaried professionals. Car lease options in your city. Youll include it on your Schedule C under line 9 for Car and Truck Expenses with your other auto expenses.

Deduction from the sales price. As an employer if you provide company cars or fuel for your employees private use youll need to work out the taxable value so you can report this. When a company leases a car for an.

Free means free and IRS e-file is included. Enter this number on line 24. You take the profit out of your company as usual and then pay for the vehicle out of your take home pay.

The lease amount you pay for a vehicle is eligible for tax relief. Car lease tax deduction calculator. Total lease payments deducted in fiscal periods before 2021 for the vehicle.

When leasing a car privately you do not have any company car related taxes to consider. Calculate tax on employees company cars.

Are Car Repairs Tax Deductible H R Block

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Potential 2020 Business Vehicle Tax Deduction Bismarck Motor Company

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Writing Off A Car Ultimate Guide To Vehicle Expenses

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Write Off A Car Lease For Your Business In 2022

Vehicle Tax Deduction 8 Cars You Can Get Tax Free Section 179 Youtube

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Vehicle Tax Deductions How To Write Off Car And Truck Expenses

How To Take A Tax Deduction For The Business Use Of Your Car

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Best Vehicle Tax Deduction 2022 It S Not Section 179 Deduction Youtube

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Maximizing Tax Deductions For The Business Use Of Your Car

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Section 179 Deduction Hondru Ford Of Manheim

Real Estate Lead Tracking Spreadsheet Free Business Card Templates Tax Deductions Music Business Cards